Best Payment Solutions April 2024

✅ 100% Manually Verified Payment Solutions coupons and promotions only. We do not scrape, or list fake coupons like our competitors.

Here's a list of The Best Payment Solutions Availabe in 2024 and that are still relevant. We compiled this list to help you make the best informed decision on choosing the right Payment Solutions that suits your needs.

What makes the best Payment Solutions?To decide which Payment Solution is the best, we rate all Payment Solutions on 6 different areas: |

|---|

Table of contents

| Rank | Name | Best Usecase | Score | Details | |

|---|---|---|---|---|---|

| #2 | Melio | 131 | Pros/Cons | Coupon/Review | |

| #1 | Veem | 351 | Pros/Cons | Coupon/Review |

The verdict: which Payment Solutions are the best in 2024

2. Melio

- Melio is a payment platform for small businesses to pay or get paid easily.

- Founded in 2018, Melio provides businesses with tools to manage payments, avoid late fees, and improve cash flow.

- Key features of Melio include:

- Ability to pay any business or individual quickly with a debit card, ACH or check.

- Tools to track payments and get reminders to pay bills on time.

- Receipt capture to keep payment records organized.

- Integrations with accounting software.

- The platform aims to replace paper checks and streamline B2B payments for SMBs.

| Melio Specifications | |

|---|---|

| Name: | Melio |

| Website: | https://www.meliopayments.com/ |

| Coupon Code: | ❌ |

| Free Credits: | ❌ |

| Free Trial: | ❌ |

| Yearly Discount: | ❌ |

| Unlimited Plan: | ❌ |

| No Creditcard Required: | ✅ |

| Read Review | |

| Affiliate Program | |

|---|---|

| Join Affiliate Program |

Melio advantages and disadvantages

| Pros | Cons |

|---|---|

|

|

Melio Key Features:

- Pay Bills: Melio allows businesses to pay bills and invoices to vendors electronically.

- Accept Payments: Melio offers tools to create invoices and receive payments from customers electronically.

- Accounting Integration: Melio integrates with accounting software like QuickBooks to sync transaction data.

- Bank Payments: Businesses can make electronic payments to vendors directly from their bank account through Melio.

- Cashback Rewards: Melio offers cashback rewards when businesses pay their bills through the platform.

- Invoice Management: The platform provides tools to create, send, track and manage invoices all in one place.

- 24/7 Support: Melio offers customer support via phone, email and chat at any time.

- Starter - $0/month. 1 user, $5,000 monthly payment volume

- Team - $29/month per user. $25,000 monthly payment volume per user

- Business - Custom pricing. Unlimited users, unlimited payment volume

1. Veem

- Veem is a global payments company founded in 2014.

- Veem's purpose is to make it easy for businesses to send and receive international payments. Veem aims to simplify cross-border transactions.

- Veem uses blockchain technology to transfer funds directly between bank accounts without going through intermediaries.

- Veem operates in over 100 countries and supports payments in over 25 currencies.

- It focuses on serving small and medium sized businesses that need to pay international suppliers and freelancers.

| Veem Specifications | |

|---|---|

| Name: | Veem |

| Website: | https://www.veem.com/ |

| Coupon Code: | ❌ |

| Free Credits: | ❌ |

| Free Trial: | ❌ |

| Yearly Discount: | ❌ |

| Unlimited Plan: | ❌ |

| No Creditcard Required: | ✅ |

| Read Review | |

| Affiliate Program | |

|---|---|

| Join Affiliate Program |

Veem advantages and disadvantages

| Pros | Cons |

|---|---|

|

|

Veem Key Features:

- Send and receive money globally: Veem allows you to easily send and receive payments between over 110 countries. You can pay anyone using just their email address or phone number.

- Bank-level security: Veem uses industry-leading security protocols and encryption to protect your money and information.

- Low fees: Veem has some of the lowest fees compared to traditional wire transfers and other money transfer services.

- Easy to use: Veem has a simple, user-friendly interface that allows you to send and receive money in just a few clicks.

- Integration with accounting software: Veem seamlessly integrates with popular accounting platforms like QuickBooks and Xero for easy payments and reconciliation.

- 24/7 customer support: Veem has multi-lingual customer support available around the clock to help with any questions or issues.

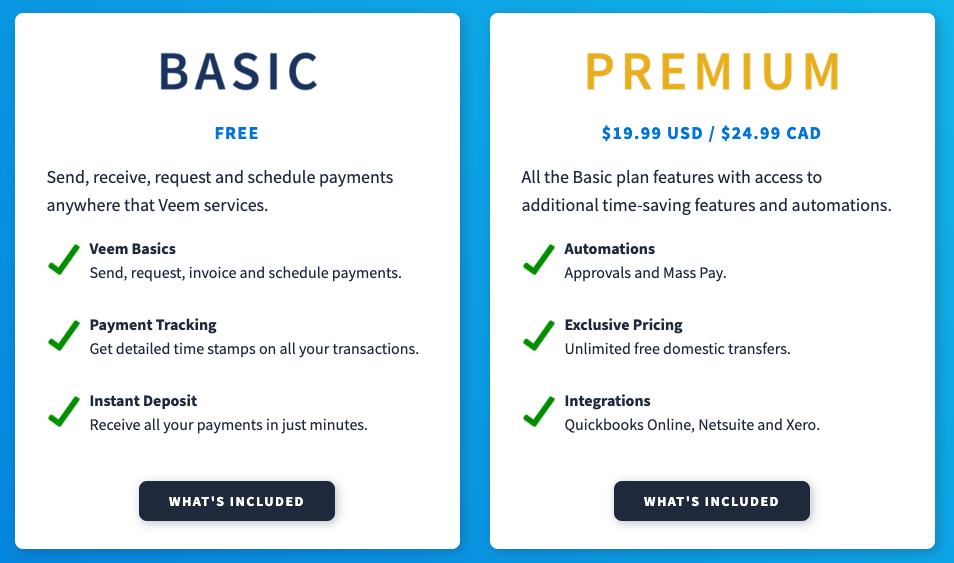

Veem Pricing

- Lite Plan: Send up to $5,000 per transaction, 2 free sends per month

- Pro Plan: Send up to $10,000 per transaction, 5 free sends per month

- Business Plan: Send up to $25,000 per transaction, 10 free sends per month

- Enterprise Plan: Customizable limits, unlimited free sends per month